Following on from last week’s breaking news on the merger between Getty Images and Shutterstock, I am back with fresh insights into this landmark deal. The corporate talking heads boast that the merger will: “benefit customers with a broader range of offerings, create new opportunities for contributors, and reaffirm a commitment to promoting inclusive and representative content.”

But let’s try to dive into what really matters: how this merger will impact contributors like you and I. We’re talking about real opportunities, potential risks and the five key questions this merger raises for contributors. Let’s get started!

The Big Numbers: What You Need to Know

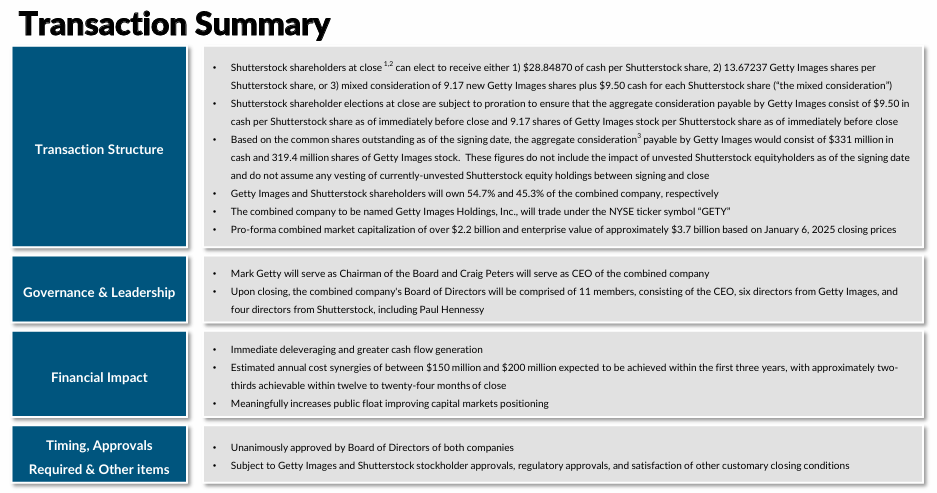

The merged company is expected to have a $3.7 billion enterprise value, with a combined library of 1 billion assets. If you’re craving the nitty-gritty financial details, feel free to dig into the press releases and transaction reports, as well as a PDF summary of the conference call with investors, otherwise, let’s focus on what matters most for contributors.

A Merger or a Friendly Takeover?

Despite being called a “merger of equals,” this deal looks more like a friendly takeover by Getty Images. While Shutterstock boasts some big-name acquisitions like TurboSquid, Rex Features, GIPHY and most recently, Pond5, it’s still the smaller player in this partnership. To add to that, despite both companies being publicly traded, the new entity will list under Getty’s ticker symbol, “GETY.” Plus the Board will consist of 6 Directors from Getty and 4 from Shutterstock.

Breaking Down the Corporate Speak: What’s Really Being Said?

Corporate language is often filled with buzzwords like “synergies” and “AI-driven future.” Let’s sift through these corporate memos and see how much substance is really there.

Shutterstock’s Message to Contributors

“Today, I’m reaching out to share an exciting development in Shutterstock’s journey. We’ve signed an agreement to combine with Getty Images in a merger of equals transaction, creating a premier visual content company dedicated to empowering creatives like you.

I understand that news like this may bring questions. Please know that until the deal is officially closed, it’s business as usual at Shutterstock. We will continue to operate under our current brand. The services and support contributors have come to expect from us, and the relationship we have, will remain. Our business will continue to operate as it always has, and we remain committed to supporting our contributors. Our commitment to you remains a top priority.

The relationships we’ve built with our contributors are at the heart of everything we do, and that will not change. Should the merger proceed, we’ll ensure you’re kept informed about significant updates, with transparency as our guiding principle.

As always, we’re here to answer your questions or concerns. Don’t hesitate to reach out to our contributor support team at any time. Thank you for being a vital part of the Shutterstock community.”

Rating the corporate bullshit on a scale of 0 to 10 (According to Chat-GTP):

This one clocks in at a 7/10 on the corporate bullshit scale. The message starts with the usual “exciting development” and “premier visual content company,” which are vague and overly optimistic buzzwords with little detail. There’s a lot of reassuring language aimed at calming contributors, such as “business as usual” and “our commitment to you remains a top priority,” but these statements, while well-intentioned, are still fairly general and lack specific assurances.

The phrases like “relationships we’ve built with our contributors are at the heart of everything we do” and “transparency as our guiding principle” sound good but are more about image management than offering tangible, actionable specifics.

Overall, it’s a mix of reassurance and fluff—attempting to build trust without saying too much. It’s careful and calculated, with an emphasis on maintaining the status quo while conveying positivity.

CEOs Speak

“Today’s announcement is exciting and transformational for our companies, unlocking multiple opportunities to strengthen our financial foundation and invest in the future—including enhancing our content offerings, expanding event coverage, and delivering new technologies to better serve our customers.”

He added, “With the rapid rise in demand for compelling visual content across industries, there has never been a better time for our two businesses to come together. By combining our complementary strengths, we can better address customer opportunities while delivering exceptional value to our partners, contributors, and stockholders” – Craig Peters, CEO at Getty Images

“We are excited by the opportunities we see to expand our creative content library and enhance our product offering to meet diverse customer needs. We expect the merger to produce value for the customers and stockholders of both companies by capitalising on attractive growth opportunities to drive combined revenues, accelerating product innovation, realising significant cost synergies and improving cash flow. We look forward to working closely with the Getty Images management team to complete the transaction and drive the next chapter of growth.” – Paul Hennessy, CEO at Shutterstock

Rating the Corporate-Bullshit according to Chat GPT on a scale of 0 to 10

This passage is a solid 8/10 on the corporate bullshit scale. The language is highly polished, filled with vague, positive-sounding phrases like “unlocking multiple opportunities,” “strengthen our financial foundation,” and “delivering exceptional value.” These terms don’t provide much concrete detail and rely heavily on aspirational or generic corporate speak.

The phrase “transformational” and the focus on “synergies,” “growth opportunities,” and “accelerating innovation” are standard tropes meant to sound strategic without giving any specifics. In essence, it’s a lot of optimistic, feel-good language meant to create excitement, but it doesn’t give much insight into tangible actions or outcomes.

They need to do better and reach at least a 9/10…perhaps one of their communications can reach this rating, such as the one by Shutterstock to its contributors.

What does the merger really mean for contributors?

So, what does this merger mean for you, the contributor? The corporate rhetoric promises “greater opportunities,” but here’s what we’re all really wondering:

Here are five critical questions that remain unanswered and I’ll tackle them one by one.

1. Will the merger actually happen?

Given the size of this deal and the monopoly it creates (representing some 75% of the market), there’s a significant chance of antitrust issues. While most analysts believe the deal is likely to pass under the current administration, it’s still up in the air.

2. Will Shutterstock disappear?

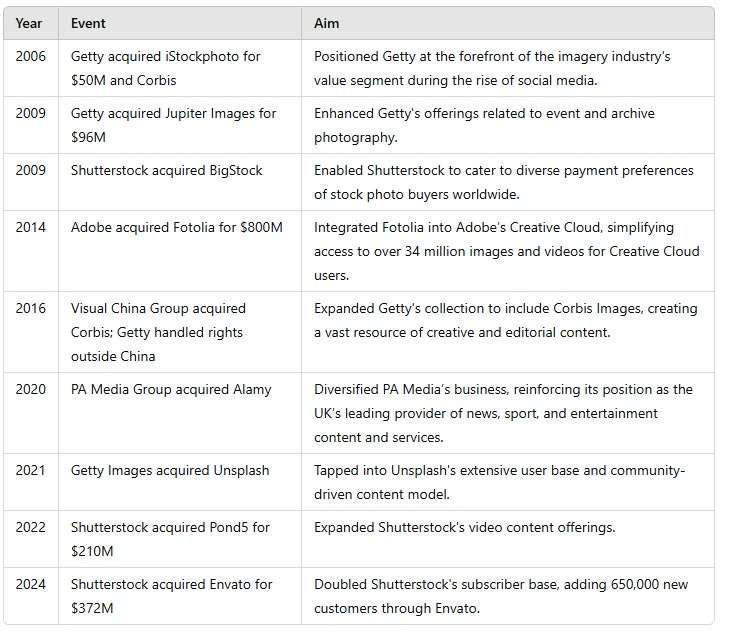

It’s unlikely that Shutterstock will completely disappear at least in the short term. The two platforms may stay separate for a while, but eventually, they could merge their royalty structures or merge entirely. Following the merger precedents in the industry indicate that many times acquired entities remain separate at least as seen by the public – see below the major occurrences since 2006:

There are many arguments for keeping the portals distinct, including:

- Maintaining high search engine rankings which took years of investment

- Offering customers different licensing options, pricing points and catering to customer locations

- A way for management to test various business strategies at different segments

3. How will this impact royalties?

Mergers like this don’t immediately disrupt the royalty structure but in the long-run there will certainly be changes to the royalty structures paid to contributors.

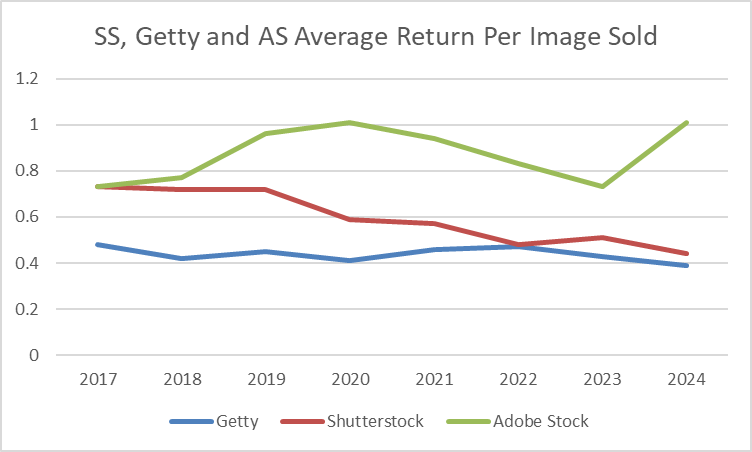

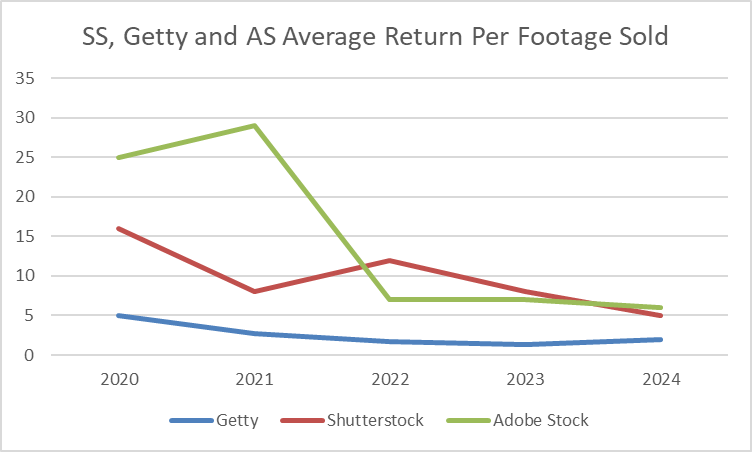

Both Getty and Shutterstock have been pioneers in the “race to the bottom”, which suggests even more cuts to royalties. I’ve crunched some historical numbers from my own port. It’s clear that Getty has always been a low-paying / bottom-feeding type of agency with their infamous 15% rate for non-exclusive content.

Shutterstock has always tried to paint itself as a better alternative and for a long time they were the highest-earning agency. But during the past few years it’s truly shocking to see how far Shutterstock has fallen, especially for footage. As you can see below they’re already almost matching iStockphoto’s average prices for both photos and footage.

The same issues, just repackaged

Therefore, for those that are worried that Shutterstock will begin to adopt the 15% royalties on non-exclusive content can rest assured that its current royalties model practiced by Shutterstock in practice is almost identical.

Those ridiculous earnings levels implemented in 2022 still guarantee that contributors continue to earn 10 cents from those subscription sales no matter what the level. As you know the system resets every January 1st. A far cry from the minimum 38cent subscriptions prior to their “exciting news” in 2022. The good ol’ days.

In any case I’d be a sucker to continue wasting my time by uploading new content giving away 85% of what I earn with no guarantee that it would even sell.

There are not as many customers as I thought

Behind the veil of all the corporate-speak it was interesting to read that both Getty and Shutterstock have a combined 1.4 million annual subscribers and customers in over 200 countries. This figure Includes Getty Images Annual subscribers plus Shutterstock Subscribers which are defined as customers who purchased one or more of their monthly recurring products for a continuous period of at least three months. I honestly thought it was at least double that number, keeping in mind that most of the subscribers are small enterprises and individuals.

4. How will other agencies respond?

Further to the Xpiks Key insights from 2024 microstock contributor survey analysis, Adobe Stock remains the favorite agency for many contributors. One key reason is the platform’s consistent royalty structure and steady sales, particularly for images. (You can see a snapshot of my own portfolio’s performance in the charts above.)

How will Adobe Stock respond to this merger? Most likely, they’ll hold back at first. Like a skilled poker player, Adobe will wait to see how Getty moves before making their own strategic play. In addition, Adobe Stock relies less on stock photo royalties and more on subscriptions earned from its Adobe programs, including Firefly and Creative Cloud.

Alamy will likely take the same approach, closely monitoring Getty’s actions as they continue to offer editorial content at lower rates than Alamy, keeping their competitive edge. But Alamy’s customer base is quite different to that of Getty even though they compete within a similar breaking news type of niche related to the entertainment and sports industry.

As for smaller agencies like Dreamstime, Depositphotos, Canva, 123RF, Freepik, Vecteezy, and others, they’ll be left scrambling for an increasingly smaller slice of the market. Unfortunately, I predict many of them will struggle to survive in this new, more consolidated landscape unless they can offer customers something special.

Storyblocks’ CEO TJ Leonard pointed out one potential big issue (via Forbes): By focusing only on saving money on costs (“cost synergies”), the new Getty Images “cannot devote to the customer.” He also said smaller companies, such as his own, can do well by focusing more on their customers’ needs and provide quality stock media.

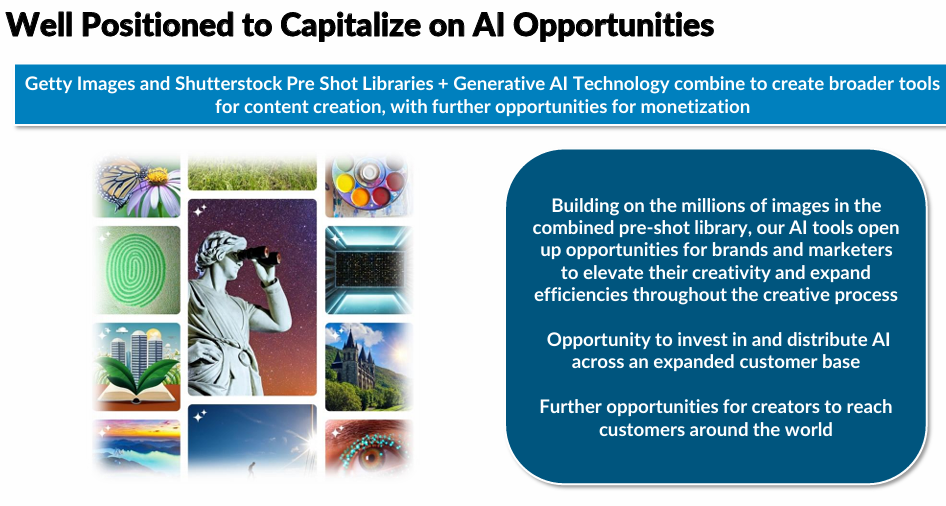

5. What about AI?

With over a billion assets between them, Getty and Shutterstock will be prime players in feeding AI systems. This raises important questions about compensation for the use of contributor content in AI training.

Here’s the slide from the January 2025 Conference Call with Investors.

Contributors to be made redundant soon?

The billion or so assets feeding the AI training machine creates an awkward situation for contributors. Eventually Getty won’t need as many contributors since customers would be able to generate the content themselves using their in-house AI tool. Except for, of course, editorial content, which is AI-proof. Below are some strategies for contributors to combat AI-redundancies.

AI-generated content backlash coming soon

At some point in the not-so-distant-future consumers may grow weary of AI-generated content and seek out “genuine human emotion” instead. As AI becomes increasingly dominant, the production of model-released lifestyle content will likely decrease, since it’s faster, cheaper, and easier to generate with AI. This shift could create an opportunity for such content to be licensed at a premium, opening up a new niche market for creators who focus on authentic, human-centered imagery.

The Potential Good News

Contributors have understandably become more skeptical in recent years, largely due to an overabundance of overly positive corporate rhetoric and years of declining returns. However, this merger could present an opportunity for Getty to finally address some critical issues and undertake much-needed “house cleaning.”

Addressing Fraudulent Accounts

Shutterstock, in particular, has faced significant problems with fraudulent accounts, an issue we’ve highlighted on this blog multiple times. The platform’s software often fails to detect similar images across different accounts, leading to repeated copyright infringements and lost revenue.

For more details, check out this post on Shutterstock’s copyright issues:

More recently, here’s a thread over at the MSG Forum with updates on shutting down such fraudulent accounts.

Beyond fraud, there are also accounts that upload massive amounts of spam, which clogs search results and degrades the overall quality of the platform. The new combined entity could use this opportunity to conduct a thorough internal audit, removing fraudulent and spammy content to improve search engine accuracy.

Cleaning Up AI-Generated Content

While both Getty and Shutterstock currently do not accept AI-generated content, there is evidence that many contributors are still uploading such material in any case and some of it is getting through the review process. The merger could offer a chance to tighten policies and improve detection methods, ensuring the platforms remain free of unauthorised AI content.

More Frequent Earnings Reporting at Getty

Currently, Getty only reports earnings on a monthly basis, typically on the 20th of each month. While some contributors may appreciate this timeline, many others, myself included, would prefer more frequent updates. A shift to daily earnings reporting would offer greater transparency and allow contributors to track their performance more effectively.

By tackling these issues head-on, the new entity could build greater trust with contributors and foster a more efficient, reliable platform for all.

Strengthening Community Engagement by bringing back the popular forum

Even though Getty has a contributor forum, it’s a far cry from the super engaging Shutterstock forum which was shut down in 2021.

Conclusion: A New Era or Just More of the Same?

As the merger between Getty and Shutterstock moves forward, there are both opportunities and concerns for contributors. While the merger promises a larger content library and improved innovation, key questions remain about fair royalties and compensation especially as Getty and Shutterstock constitute a large share of most contributors’ revenue.

If past trends of declining royalties continue, contributors may seek better alternatives. Ultimately, this merger could either revitalize the industry or reinforce the status quo, and contributors should stay informed and adaptable as the situation evolves.

This is a huge topic and stay tuned on this blog for updates on the merger and how it will impact contributors’ earnings.

About Alex

I’m a bit of an eccentric, based in Lisbon, Portugal, and on a mission to explore every corner of the globe. Along the way, I’ve been capturing stock images and footage, dedicating the last ten years to building a career as a travel photographer, videographer, and freelance writer. My goal? To inspire others by sharing unique insights into this fascinating industry—while calling out scammers when necessary.

I’m proud to have written a book about my adventures which includes tips on making it as a stock travel photographer – Brutally Honest Guide to Microstock Photography

Hi Alex,

Thanks for your article.

I still miss the Shutterstock forum. I don’t expect it to come back after the merger.

I wonder if I would recommend Stock Photography to anyone now. Maybe people like me, who would otherwise save the photos on the computer. But the more professional photographers?

I see the best future in Adobestock. Although Shutterstock has sometimes had higher outliers in terms of payment so far.

Regards, Thijs

LikeLiked by 1 person

[…] […]

LikeLike